It’s safe to say that AI has been a major talking point in financial services over the past few years. Amid the generative AI rise, another branch of this technology is capturing the industry’s attention: AI agents. These agents are on track to transform financial services by introducing autonomous systems capable of making decisions with minimal human intervention. From streamlining back-office operations to enhancing risk management, these intelligent agents have the potential to redefine how banks and FinTech firms operate. But what does this mean for the future of banking? As we move closer to AI-driven decision-making, questions around trust, control and regulation become increasingly important.

What are AI agents and how is it crucially different from other types of AI, like machine learning and generative AI?

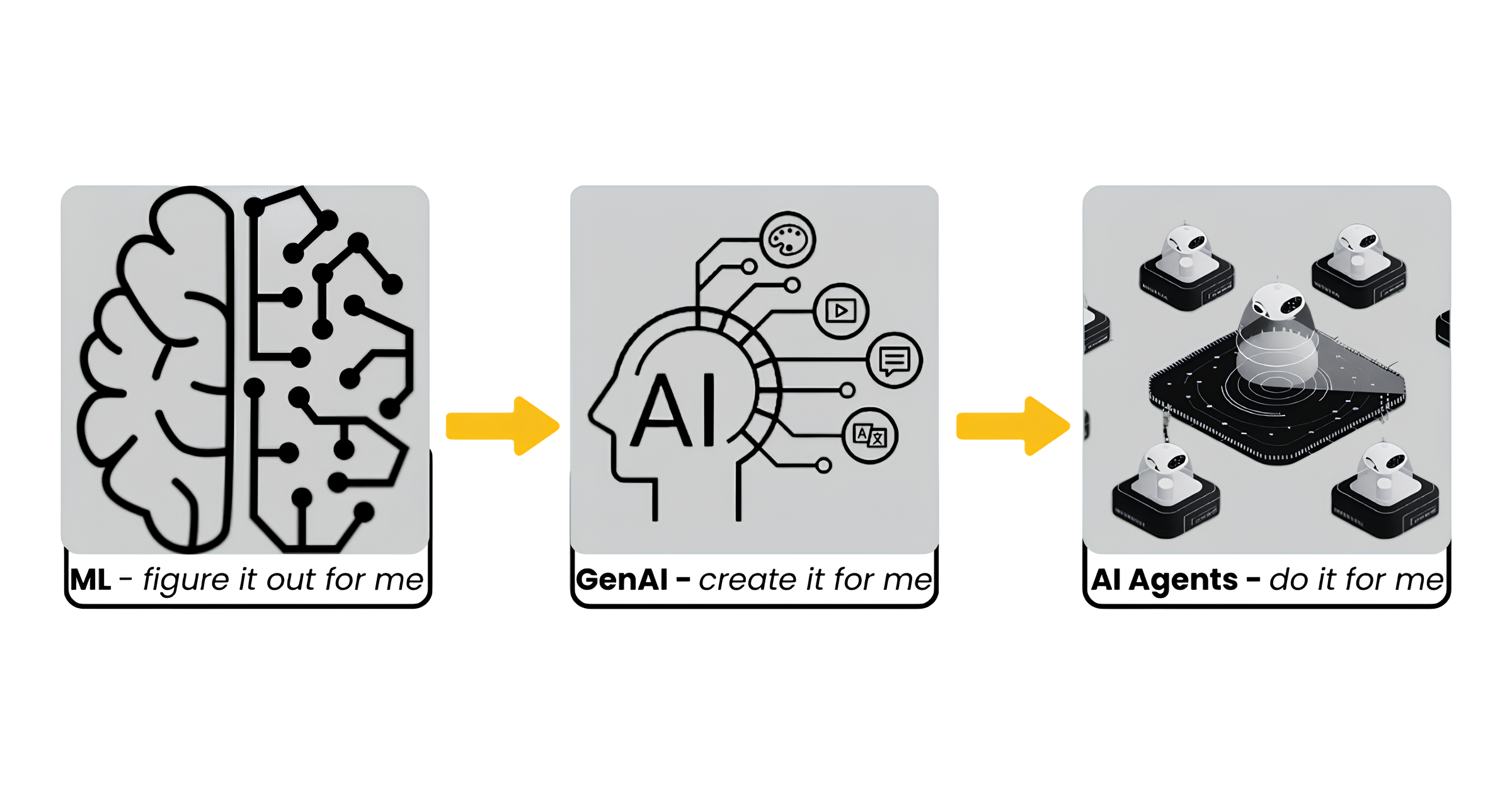

Let’s start by looking at machine learning which is best understood as the “show it to me” or “figure it out for me” technology. It analyzes data, provides insights and makes recommendations. For example, in financial services, it can detect anomalies by flagging unusual payment behaviour, helping improve workflows.

Generative AI, on the other hand, is the “create it for me” technology. It doesn’t just analyze data but it also generates new content based on your input. In financial services, GenAI can be used to draft loan agreements or credit memos: you provide information, risk metrics and terms, and the AI produces a ready-to-review document.

Finally, AI agents are representing the “do it for me” technology. It. Unlike traditional chatbots that only answer questions, AI agent acts on your behalf, can perform tasks and make decisions. In financial services, for example, an AI agent could handle a credit card dispute by not just providing information but also managing the resolution process.

These three types of AI: machine learning, generative AI and AI agents, represent different levels of capability, from analyzing data, to creating content, to taking autonomous action.

How advanced are AI agents in financial services today and are there any real world use cases live at the moment?

AI agents in financial services are still in early development. While many institutions are running pilots, fully production-ready agents remain rare due to complex infrastructure needs, limited high-quality data, and regulatory hurdles. Most use cases are still experimental. However, the industry is shifting from rule-based systems to more dynamic, context-aware agents that can learn and act autonomously. With strong AI governance and collaboration across legal, compliance, and engineering teams, firms are preparing to adopt these agents more effectively soon.

Types of AI Agents:

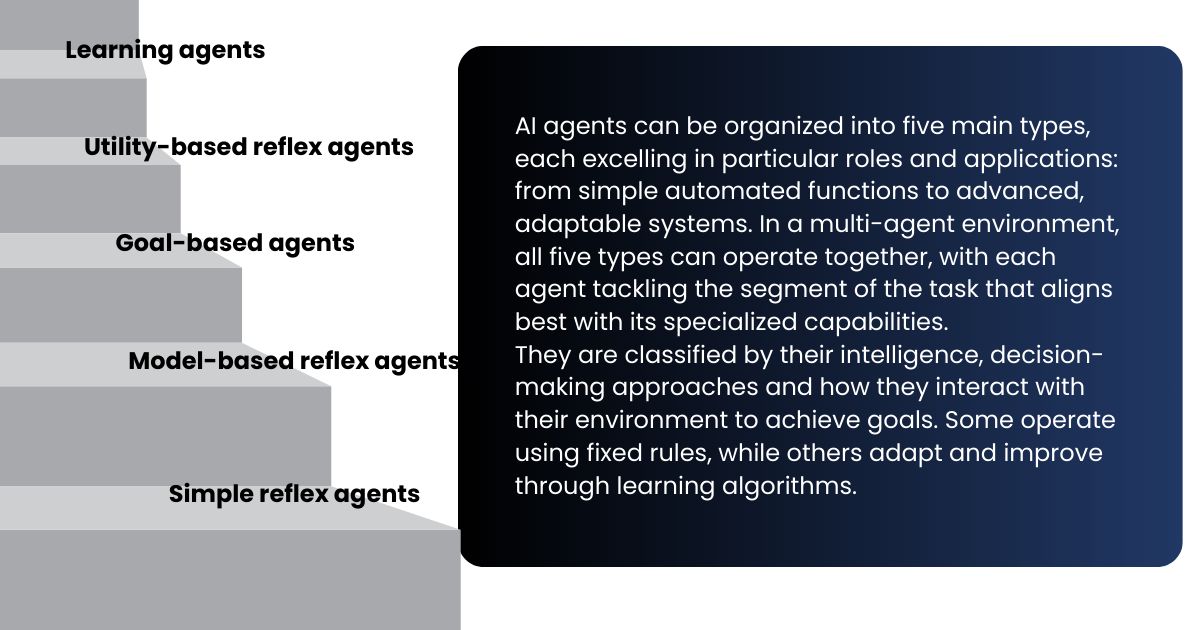

Simple reflex agents represent a basic AI system that responds directly to current environmental inputs using predefined condition-action rules, without considering past experiences or future consequences. Examples include traffic lights that change signals according to sensor data. While effective in stable, predictable environments, these agents cannot learn or adapt, limiting their use in complex or dynamic situations.

Model-based reflex agents improve on simple reflex agents by maintaining an internal model of the environment, which helps them track past states and understand how previous actions affect the current situation. This allows them to make more informed decisions in partially observable or dynamic environments, such as a robot navigating a room by remembering obstacle locations. While more adaptable than simple reflex agents, they still rely on predefined rules and lack advanced learning or reasoning capabilities.

Goal-based agents enhance model-based reflex agents by focusing on achieving specific objectives through planning and reasoning rather than just reacting to immediate stimuli. They evaluate possible actions based on how well they advance their goals, allowing them to anticipate future states and choose optimal paths, such as a robot planning a route to a target location while avoiding obstacles. Though more flexible and proactive, goal-based agents often rely on predefined strategies and are suited for dynamic, partially observable environments where strategic decision-making is essential.

Utility-based reflex agents enhance goal-based agents by using a utility function to evaluate and select actions that maximize overall benefit across multiple criteria. Instead of simply achieving a goal, they assess various possible outcomes, assigning utility values to balance trade-offs, such as a self-driving car weighing speed, fuel efficiency and safety to choose the best route. This approach enables more nuanced and flexible decision-making in complex, dynamic environments, even though designing accurate utility functions can be challenging due to the need to consider multiple factors and their impacts.

Learning agents improve their performance by adapting based on experience and feedback from the environment, unlike agents that rely solely on fixed rules. It consists of four key components: a performance element that makes decisions, a learning element that updates knowledge, a critic that evaluates actions and provides feedback, and a problem generator that encourages exploration to discover better strategies. This adaptability allows learning agents to handle complex, changing environments effectively, making them valuable in applications like autonomous driving, robotics, virtual assistants and personalized recommendation systems.

Specific AI agents use cases in finance industry:

- AI Agents in Contract Processing

AI-managed contracts are intelligent, self-executing agreements that respond to real-world data and regulatory changes. They can trigger actions, send alerts, and adjust terms as conditions evolve. In finance, they help manage compliance by tracking updates, notifying stakeholders, and automating necessary changes, reducing manual effort and regulatory risk. Other industries like supply chains, insurance and legal services can also benefit from these dynamic, responsive contracts.

- AI Agents in Insurance

AI agents are transforming insurance by automating claims and improving risk profiling in underwriting. Multi-agent systems collect real-time data from various sources to build a 360-degree view of customer risk. This enables automated underwriting and hyper-personalized policies with minimal human input. While the benefits are clear, regulators like Europe’s IOPA and the FCA stress the need to ensure such personalization does not reduce access to insurance for some individuals.

This balance between innovation and fairness is a key challenge as AI agents reshape the insurance landscape.

- AI Agents in Regulation and Compliance

Regulation and compliance rely on large volumes of unstructured data, often managed manually. AI agents can rapidly interpret complex regulations like PSD3 and connect them to internal policies, reducing time and effort. By automating analysis and offering insights, they lighten compliance workloads, accelerate processes, and unlock the value hidden in millions of documents across banks and institutions.

AI agents examples in other industries:

- Healthcare: AI agents support diagnostics, personalized treatment plans, real-time patient monitoring and automates administrative tasks. It helps improve outcomes by alerting care teams and optimizing interventions.

- Customer Service: Autonomous AI agents independently handle complex customer inquiries, provide tailored responses and manage multi-channel support, enhancing efficiency and customer satisfaction.

- Logistics and Supply Chain: AI agents optimizes routing, manages inventory autonomously, predicts demand and handles disruptions in real time, improving delivery accuracy and reducing costs.

- Retail and eCommerce: AI agents create hyper-personalized shopping experiences, manage customer interactions, prevent cart abandonment and run dynamic marketing campaigns to boost sales and loyalty.

- Manufacturing and Industry: AI agents enables predictive maintenance, quality control, resource optimization and autonomous scheduling, reducing downtime and increasing productivity.

- Travel and Hospitality: AI agents provides real-time travel assistance, personalized itinerary planning, disruption management and price predictions, enhancing traveller experience and operational efficiency.

How Long Until Fully Autonomous Agents Act Proactively on Behalf of Users?

This future is closer than many expect. Simpler use cases could see wide adoption within three years while more complex areas like risk management, regulation, customer experience and financial advice may take longer to automate. In large financial institutions adoption depends on significant technology upgrades and better data infrastructure which many firms still lack. Despite these challenges the potential return on investment is strong with major savings in cost, time and complexity. However progress is often fragmented as organizations adopt isolated AI solutions without a unified strategy to unlock the full benefits.

As the conversation around AI agents evolves, a new concept is gaining attention called agentic AI. While AI agents perform tasks and make decisions within set parameters, agentic AI takes a step further with systems that are more autonomous, goal-driven and adaptable. These systems often involve multiple agents working together but are distinct in their ability to set goals, respond to changing environments and act independently. In financial services, this opens the door to applications that go beyond task automation such as AI that anticipates emerging risks, adjusts strategies in real time, or independently navigates complex regulatory changes. Agentic AI builds on the foundation of AI agents but pushes the boundaries of what intelligent systems can do.

The reality is every business, department and operation will be using generative AI and AI agents. AI agents are sophisticated applications built differently from traditional software, which adds some complexity. But fundamentally, an agent is a tool designed to solve a specific problem, often working alongside other agents.

The key is to balance innovation with risk, leveraging AI agents thoughtfully to unlock value while managing potential pitfalls.

UHURA IS AN AI PLATFORM THAT READS AND UNDERSTANDS COMPLEX DOCUMENTS JUST AS HUMANS DO. WE HELP BUSINESSES SPEED UP THE REVIEW AND DECISION-MAKING PROCESSES BY USING AI TO UNCOVER VALUABLE INSIGHTS FROM DOCUMENTS, REPORTS, CONTRACTS AND AGREEMENTS. WE USE CUTTING-EDGE AI, INCLUDING IMAGE PROCESSING, NATURAL LANGUAGE PROCESSING AND MACHINE LEARNING TECHNOLOGY, TO BRING UNPRECEDENTED ACCURACY AND SHORTEN DOCUMENT PROCESSING TIME FROM HOURS TO SECONDS