The Shift: From Intelligent to Agentic Automation

The last decade was about automating repetitive tasks. Tools like RPA and Intelligent Document Processing (IDP) helped enterprises streamline manual work – digitizing data entry, KYC checks, and invoice handling.

But today, automation is evolving from task-based to goal-oriented. Agentic Process Automation (APA) represents this next leap, systems made up of autonomous AI agents that understand objectives, plan actions, collaborate with humans, and continuously adapt to changing business conditions.

In industries like finance, compliance, and insurance, this evolution marks a profound shift: from processing data to achieving business outcomes.

What Is Agentic Process Automation?

APA integrates multiple advanced AI capabilities – cognitive understanding, reasoning, orchestration, and learning – into a single framework.

An agentic system can:

- Interpret goals and context, not just commands.

- Plan and adapt dynamically across complex, multi-system processes.

- Coordinate with other agents and humans to complete end-to-end workflows.

- Continuously learn from feedback and outcomes to improve over time.

- It’s automation that thinks, adapts, and evolves.

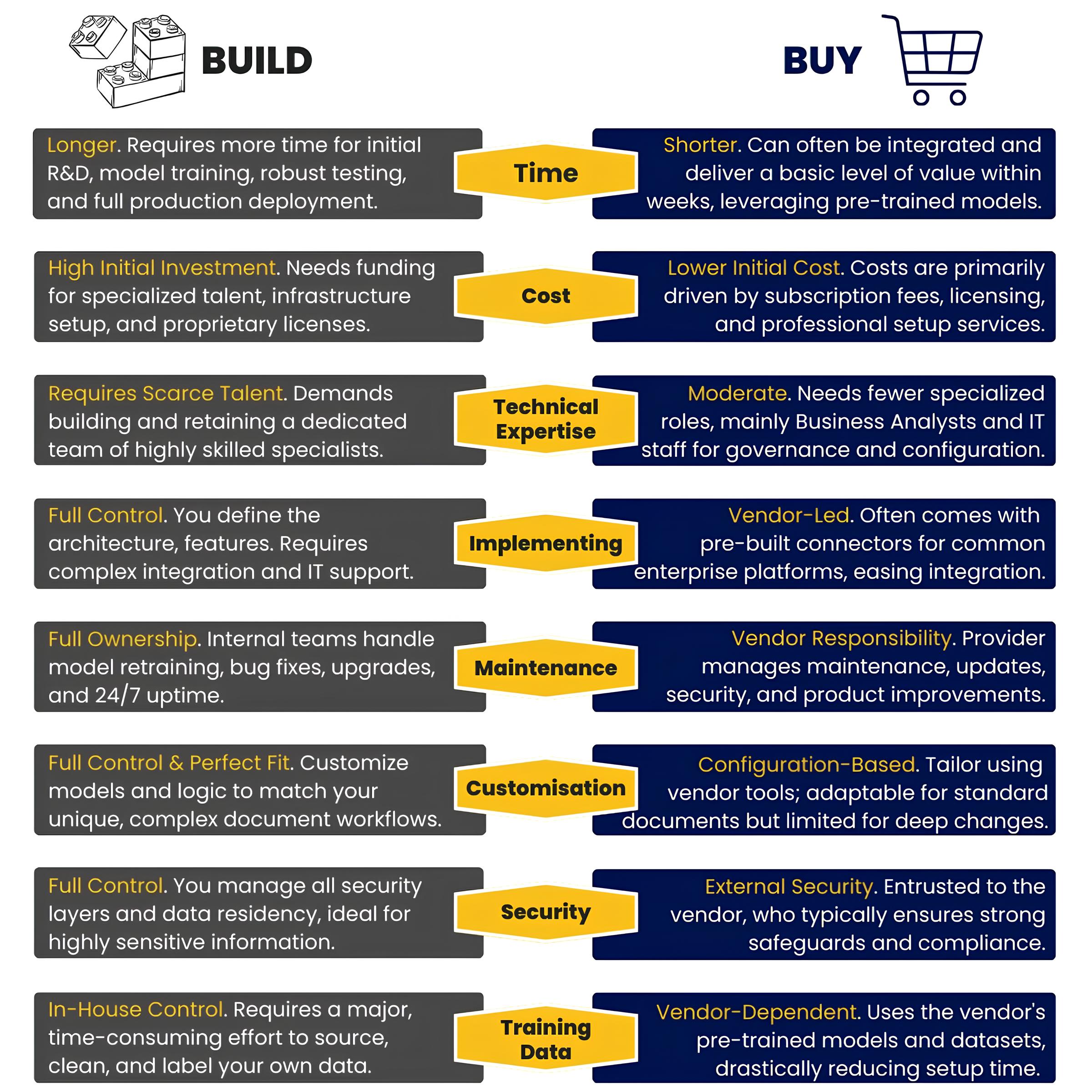

Build vs. Buy: The New Strategic Choice

Implementing APA brings organizations to a familiar crossroads, but the implications are far greater than before.

Joining Expertise

Forward-thinking organizations are taking a hybrid approach, adopting a robust APA platform as a base, then extending it with proprietary agents, domain models, or custom data connectors.

True value emerges when technological expertise meets institutional intelligence: Vendors deliver the advanced platforms, AI capabilities, and implementation experience that accelerate transformation; Financial institutions contribute their deep understanding of regulatory landscapes, risk frameworks, and client dynamics. Together, they create a partnership where innovation meets context – turning generic technology into strategic advantage.

This strategy balances speed and innovation:

- Rapid deployment through a ready-made foundation.

- Strategic control over critical processes and business IP.

Platform Example: Bridging the Gap with Uhura

Platforms like Uhura exemplify this hybrid model.

While offering a powerful agentic automation framework, Uhura remains flexible enough to adapt to the complex workflows of financial institutions and regulated industries.

Its architecture enables autonomous agents to coordinate tasks like loan onboarding, credit analysis, and compliance reporting. With Uhura, enterprises get the intelligence and scale of a purpose-built AI platform without having to build one from scratch.

Final Thought: From Efficiency to Autonomy

Agentic Process Automation isn’t just another wave of automation.

It’s the foundation for autonomous enterprise systems that reason, learn, and optimize outcomes continuously.

Platforms like Uhura are designed precisely to close the gap between off-the-shelf software and a perfect custom build. While it is a robust APA solution, it is pre-configured and highly adaptable to the specific and complex workflows of the financial sector. Uhura leverages AI to emulate human document analysis, processing massive volumes with minimal effort. This means you gain the speed and power of a dedicated AI platform while achieving the workflow precision and contextual understanding typically associated only with a deeply customized, in-house solution. Stop worrying about being an AI software company and focus on being a financial leader.

UHURA IS AN AI PLATFORM THAT READS AND UNDERSTANDS COMPLEX DOCUMENTS JUST AS HUMANS DO. WE HELP BUSINESSES SPEED UP THE REVIEW AND DECISION-MAKING PROCESSES BY USING AI TO UNCOVER VALUABLE INSIGHTS FROM DOCUMENTS, REPORTS, CONTRACTS AND AGREEMENTS. WE USE CUTTING-EDGE AI, INCLUDING IMAGE PROCESSING, NATURAL LANGUAGE PROCESSING AND MACHINE LEARNING TECHNOLOGY, TO BRING UNPRECEDENTED ACCURACY AND SHORTEN DOCUMENT PROCESSING TIME FROM HOURS TO SECONDS