AI Document Processing in Asset Finance: How Uhura Increases Efficiency

The Hidden Cost of Manual Processing In the world of asset finance, time and accuracy are everything. Lenders working with loans and leases secured by equipment are under constant pressure to process client applications quickly, without sacrificing quality. But in practice, the process is often slowed down by manual document handling. A new lender might […]

Credit Union AI Operations: Bridging Trust and Technology

Serving Communities, Adopting Innovation Credit unions have long provided accessible financial services in places where traditional banks fall short. Their not-for-profit model supports a focus on people rather than profit. This foundation of trust and local engagement has made them resilient over decades, but it also highlights the challenge ahead: keeping pace with a financial […]

WHITEPAPER – Transforming Banking with AI Agents: The Uhura Solutions Perspective

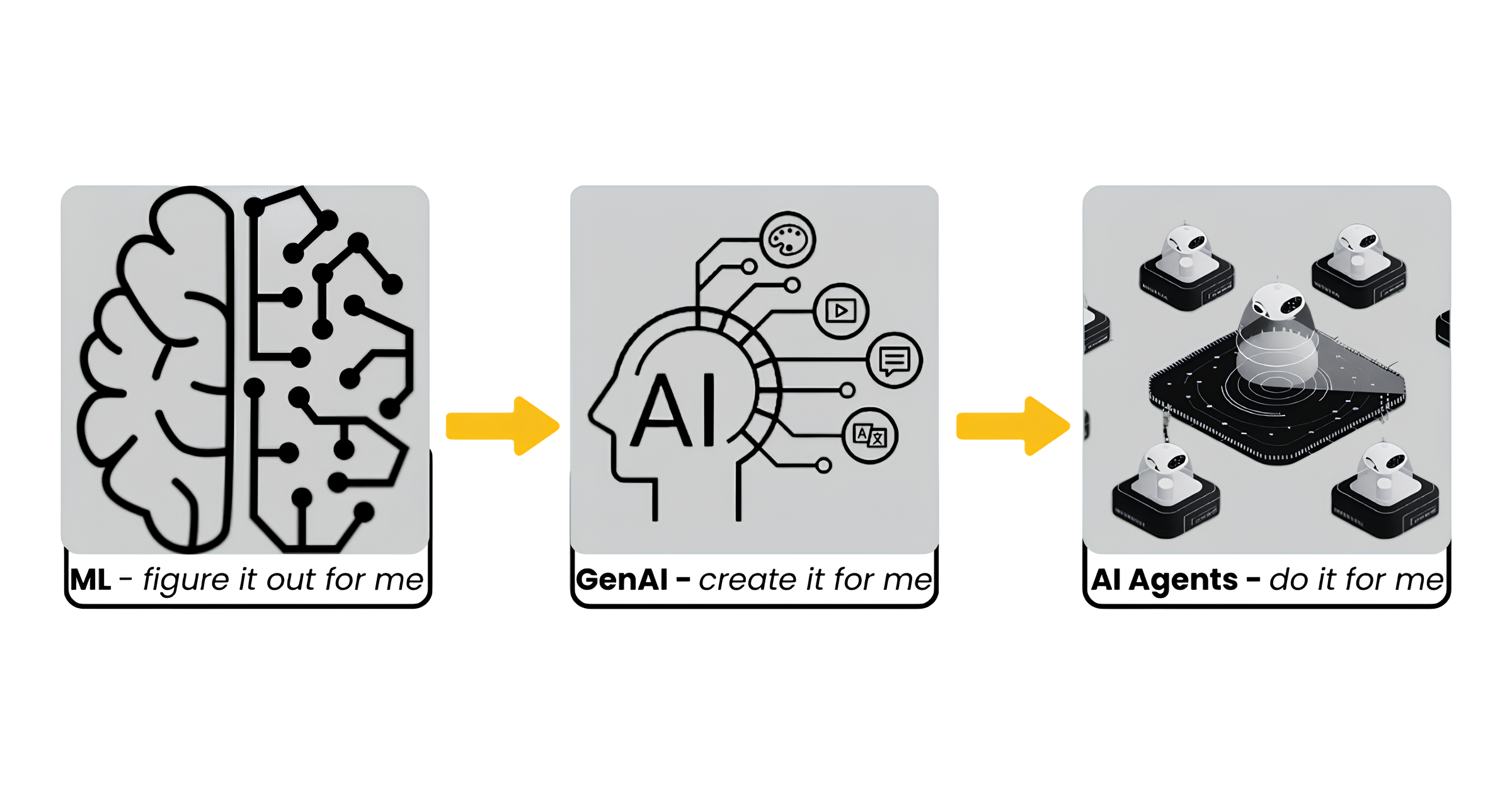

Discover how autonomous AI is redefining the future of financial services. Download our whitepaper: Transforming Banking with AI Agents: The Uhura Solutions Perspective The question is no longer if banks should adopt AI, but how quickly they can integrate it to stay ahead. The next evolutionary leap is here: AI Agents. These are not just automation tools; they are goal-driven […]

AI Agents: The Next Step

It’s safe to say that AI has been a major talking point in financial services over the past few years. Amid the generative AI rise, another branch of this technology is capturing the industry’s attention: AI agents. These agents are on track to transform financial services by introducing autonomous systems capable of making decisions with […]

From Insight to Impact: The AI-Powered Future of Banking

Artificial Intelligence isn’t a future concept in banking, it’s already redefining the industry. From automating routine tasks to delivering deep insights and enhancing customer experiences, AI is powering a new era of smarter, faster, and more agile financial services. This isn’t about replacing people. It’s about empowering them, freeing teams from manual processes so they […]

Automating Retail and Corporate Loan Processing: The Future of Lending with AI

Financial institutions face mounting pressure to process loans faster, more accurately, and more transparently while maintaining strict compliance and delivering a high-quality customer experience. As application volumes increase and the complexity of financial products grows, traditional manual processes are no longer efficient or sustainable. Recent advances in Artificial Intelligence (AI) and Machine Learning (ML) are […]

WHITEPAPER: The Transformative Power of AI in Banking

Explore our new white paper, The Transformative Power of AI in Banking, to learn how AI is revolutionizing operations, from customer onboarding and loan document management to instant data analysis and workflow automation. Discover how financial institutions are leveraging AI to boost compliance, empower employees, and deliver exceptional customer experiences in today’s fast-evolving digital economy. […]

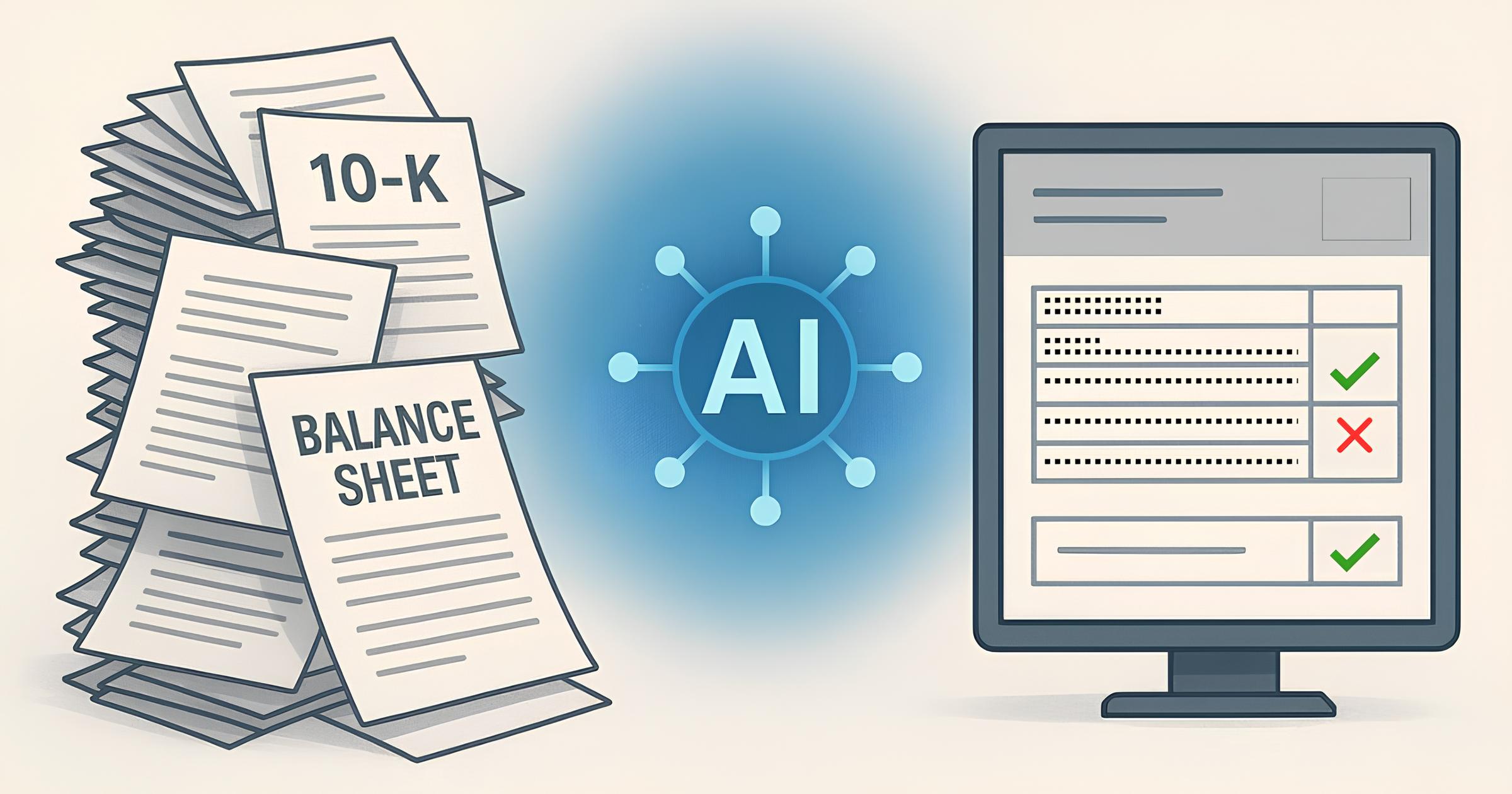

AI and Document Processing: How Uhura Solutions Transforms Business Operations

Businesses today face the challenge of processing an overwhelming volume of documents, often in multiple formats and types. From structured tables to unstructured paragraphs, with checkboxes, seals, signatures and complex data extraction needs, manual handling slows down workflows, introduces errors, and drains resources. Uhura Solutions provides an AI-powered platform designed to eliminate these inefficiencies. Used […]

Transforming Document Classification with AI

In today’s data-driven business landscape, companies manage an immense volume of documents daily, from invoices and contracts to customer correspondence and regulatory filings. Efficient and accurate document classification is no longer just an administrative task, it’s a strategic necessity for maintaining streamlined operations and meeting compliance standards. Traditionally, document classification has always been a highly […]

Uhura – An AI Platform for Automating Document Driven Processes

The platform allows businesses to access sophisticated AI through the automation of complex processes that include data extraction and classification, document review and intelligent analysis. The company leverages cutting-edge technologies such as Large Language Models (LLMs) enhanced by domain-specific datasets and reinforcement learning, process automation workflows, and a low-code framework. UHURA IS AN AI PLATFORM THAT […]