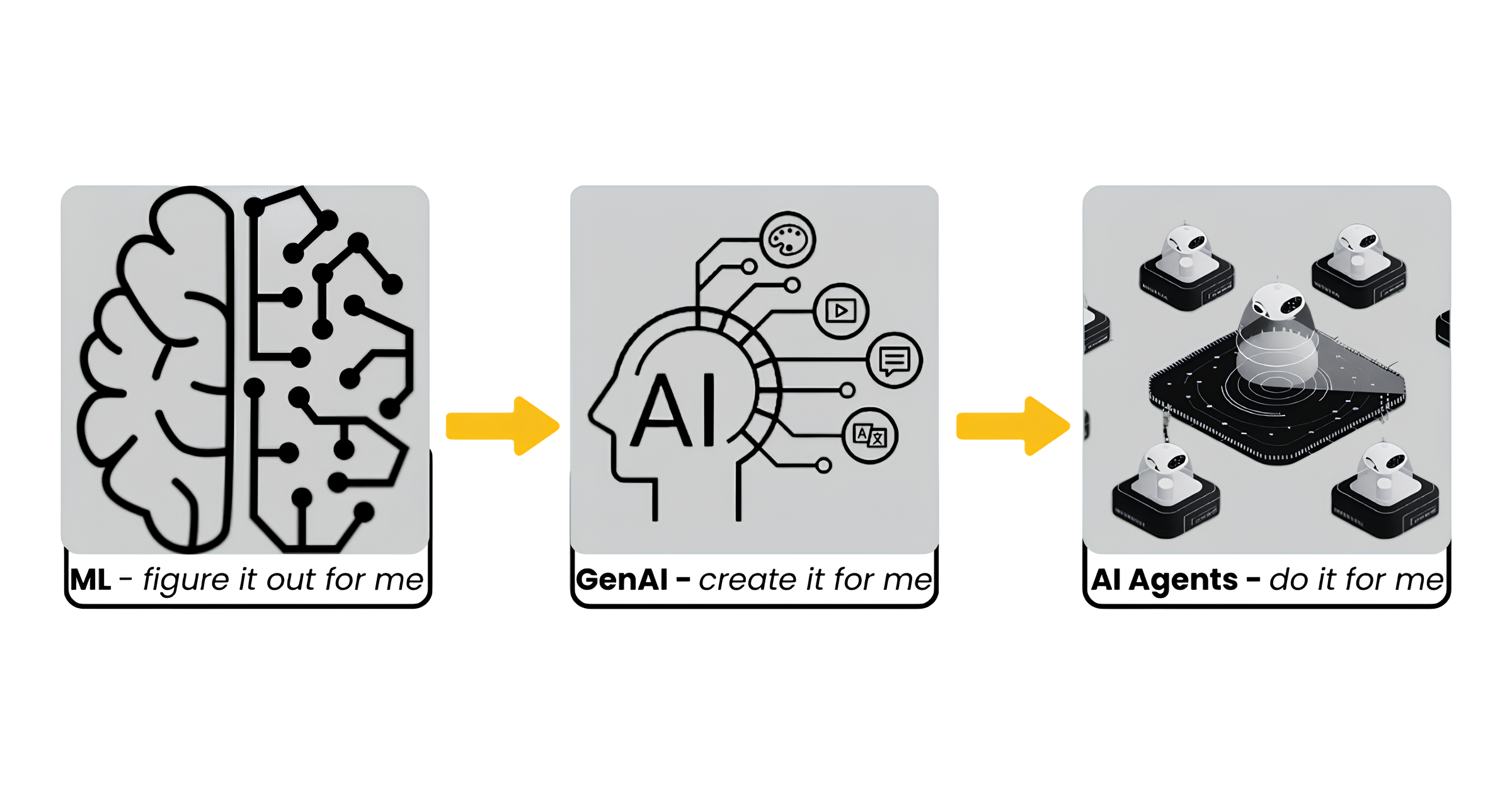

Agentic AI, Gen AI, or Traditional AI: Choosing the Right Approach for Digital Transformation

Artificial intelligence is reshaping the financial industry, but the most important question today isn’t whether to use AI, but which approach to deploy. The three main forms, Traditional (Predictive) AI, Generative AI (Gen AI), and Agentic AI, represent different levels of intelligence, autonomy, and risk. For banks and other financial institutions, choosing the right one depends on specific […]

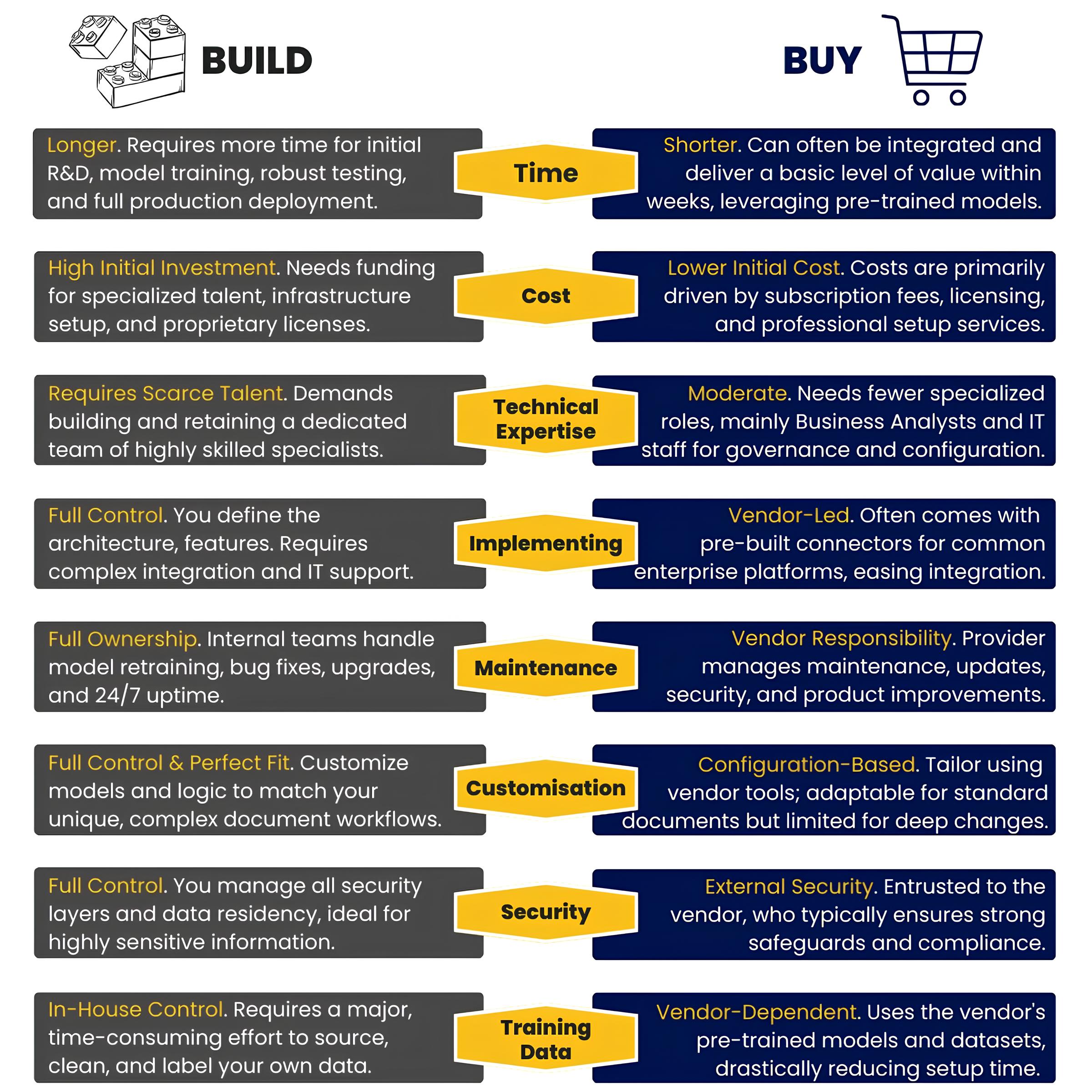

Build vs. Buy: Navigating the Agentic Process Automation Decision

The Shift: From Intelligent to Agentic Automation The last decade was about automating repetitive tasks. Tools like RPA and Intelligent Document Processing (IDP) helped enterprises streamline manual work – digitizing data entry, KYC checks, and invoice handling. But today, automation is evolving from task-based to goal-oriented. Agentic Process Automation (APA) represents this next leap, systems […]

Understanding AI Agents: From Concept to Real-World Impact

Artificial Intelligence is no longer just about chatbots, image classifiers, or recommendation systems. The field is evolving toward something more powerful – AI Agents. They’re autonomous software entities that can plan, act, adapt, and learn. They don’t just respond to prompts, they make decisions, execute tasks, and improve through experience. Done right, they represent a […]

AI-Powered ESG Insights

In today’s business world, environmental, social, and governance (ESG) practices are no longer optional, they’re essential to long-term resilience and competitiveness. Stakeholders ranging from investors and regulators to employees and customers are demanding greater accountability, transparency, and measurable impact. For companies, this means that ESG reporting is not just about compliance; it has become a […]

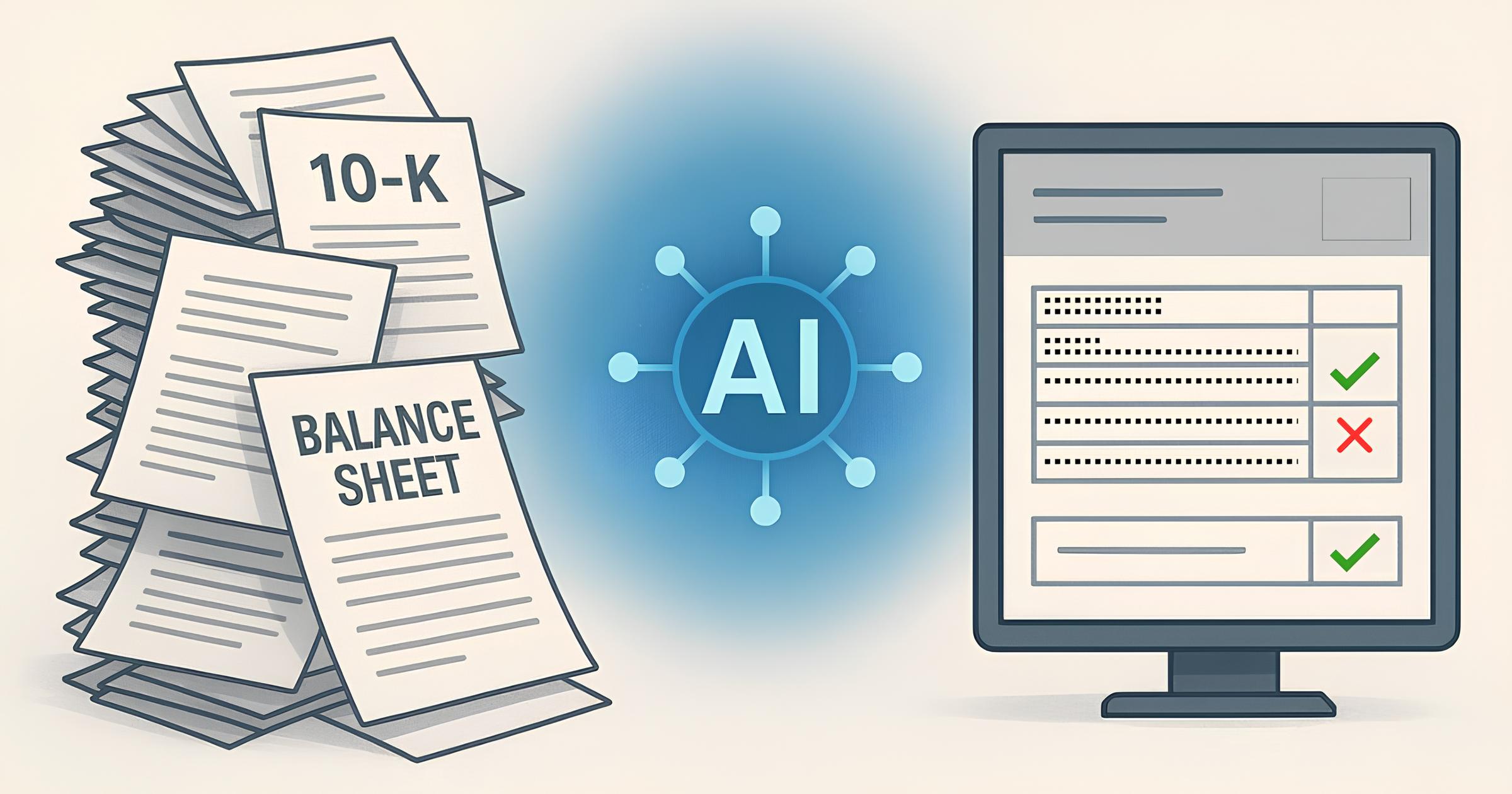

Deploying AI in Private Equity: Transforming Document-Centric Processes

Artificial intelligence has become a transformative force reshaping the private equity (PE) landscape. While capital availability, industry expertise, and strong networks have long been the foundations of success in this sector, the rapid rise of AI is adding a new dimension: speed, precision and scalability. Private equity firms deal with an immense volume of information, […]

AI in Banking: The Data Quality Imperative

Artificial intelligence is reshaping the financial services industry. From fraud detection to hyper-personalized customer engagement, banks are racing to unlock the value of AI, including the newest waves of generative AI and agentic AI. Yet beneath the hype lies a hard truth: without high-quality data, AI will not deliver transformative outcomes. Banks that fail to […]

AI Document Processing in Asset Finance: How Uhura Increases Efficiency

The Hidden Cost of Manual Processing In the world of asset finance, time and accuracy are everything. Lenders working with loans and leases secured by equipment are under constant pressure to process client applications quickly, without sacrificing quality. But in practice, the process is often slowed down by manual document handling. A new lender might […]

Credit Union AI Operations: Bridging Trust and Technology

Serving Communities, Adopting Innovation Credit unions have long provided accessible financial services in places where traditional banks fall short. Their not-for-profit model supports a focus on people rather than profit. This foundation of trust and local engagement has made them resilient over decades, but it also highlights the challenge ahead: keeping pace with a financial […]

WHITEPAPER – Transforming Banking with AI Agents: The Uhura Solutions Perspective

Discover how autonomous AI is redefining the future of financial services. Download our whitepaper: Transforming Banking with AI Agents: The Uhura Solutions Perspective The question is no longer if banks should adopt AI, but how quickly they can integrate it to stay ahead. The next evolutionary leap is here: AI Agents. These are not just automation tools; they are goal-driven […]

AI Agents: The Next Step

It’s safe to say that AI has been a major talking point in financial services over the past few years. Amid the generative AI rise, another branch of this technology is capturing the industry’s attention: AI agents. These agents are on track to transform financial services by introducing autonomous systems capable of making decisions with […]