One Platform

Multiple Processes

Endless Possibilities.

Put a single platform to work across your company and effortlessly automate multiple complex processes

One Platform

Multiple Processes

Endless Possibilities.

Put a single platform to work across your company and effortlessly automate multiple complex processes

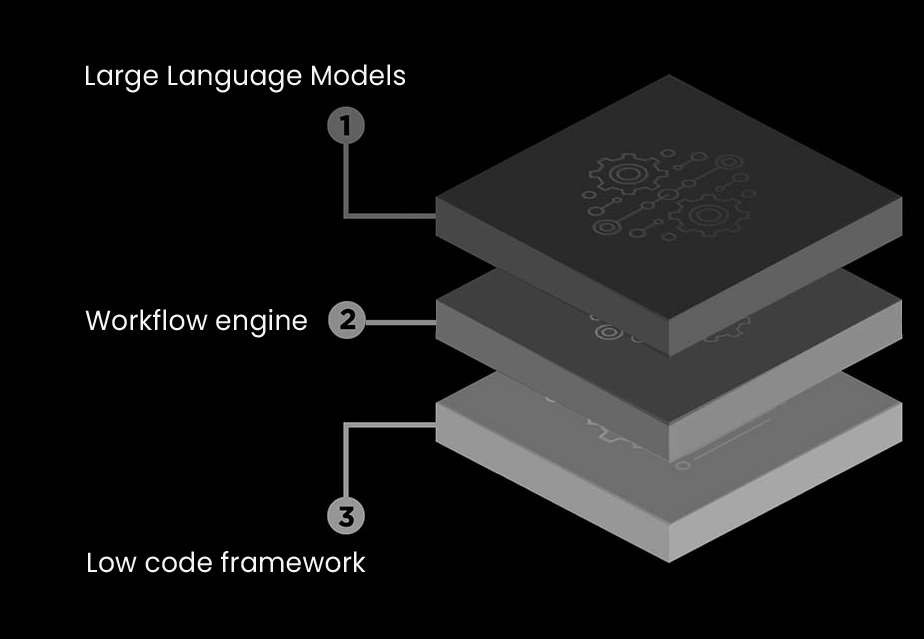

An AI platform for document-driven process automation

Transforming the financial industry, Uhura is the next-generation AI platform that seamlessly integrates Fine-Tuned Large Language Models (LLMs), process automation workflows and low-code framework. Empowering financial institutions to manage, optimize, and transform their processes, Uhura represents the future of automation – where innovation drives efficiency.

Large Language Models (LLMs)

The fine-tuned LLMs add a layer of specialization that distinguishes the solution in the market. By implementing pre-trained models to the specific needs of the financial industry, the platform is positioned to offer more accurate and relevant insights compared to generic AI solutions.

Workflow Engine

The workflow engine allows users to utilize building blocks to generate a decision logic that emulates internal business processes. The interface enables business users to define inputs and outputs and necessary operations by using visual building blocks, without IT involvement—and with little to no programming knowledge.

Low-code Framework

The integration of a low-code framework is a game-changer, allowing businesses to rapidly prototype and deploy AI-driven models without the need for extensive coding expertise. This accelerates time-to-market, ensuring that businesses can capitalize on market opportunities swiftly and effectively.

Industry-specific knowledge

The platform is meticulously crafted to address the distinctive needs of the financial sector. It understands the specialized language, regulations, and intricacies of finance, making it a tailored solution that resonates with financial institutions, banks, and other industry players.

AI-driven precision

By integrating advanced AI and machine learning, the platform can perform complex tasks with a level of precision that surpasses traditional methods. It can analyze vast amounts of data, recognize patterns, and make informed decisions, enabling more accurate outcomes and reducing errors.

Implementation time

The low-code development framework empowers users, even those without extensive technical backgrounds, to create customized AI-driven models. This adaptability allows businesses to tailor the solution to their specific workflows, ensuring maximum efficiency and relevance.

Resources

Artificial intelligence is reshaping the financial industry, but the most important question today isn’t whether to use AI, but which approach to deploy. The three …

The Shift: From Intelligent to Agentic Automation The last decade was about automating repetitive tasks. Tools like RPA and Intelligent Document Processing …

Artificial Intelligence is no longer just about chatbots, image classifiers, or recommendation systems. The field is evolving toward something more powerful – …

In today’s business world, environmental, social, and governance (ESG) practices are no longer optional, they’re essential to long-term resilience and competitiveness. Stakeholders …

Artificial intelligence has become a transformative force reshaping the private equity (PE) landscape. While capital availability, industry expertise, and strong networks have …

Artificial intelligence is reshaping the financial services industry. From fraud detection to hyper-personalized customer engagement, banks are racing to unlock the value …

The Hidden Cost of Manual Processing In the world of asset finance, time and accuracy are everything. Lenders working with loans and …

Serving Communities, Adopting Innovation Credit unions have long provided accessible financial services in places where traditional banks fall short. Their not-for-profit model …

Discover how autonomous AI is redefining the future of financial services. Download our whitepaper: Transforming Banking with AI Agents: The Uhura Solutions …

It’s safe to say that AI has been a major talking point in financial services over the past few years. Amid the …

In the banking business, where data, regulation, customer expectations, and innovation intersect daily, the role of the Business Analyst (BA) has always …

As regulatory demands intensify and customer expectations accelerate, KYC has become a strategic priority for banks and not just a compliance formality. …

Talk to an expert

Discover how our next-generation AI solutions can transform your business operations, drive efficiency, and provide you with a competitive edge. Embrace the future of intelligent automation with us.

Talk to an expert

Discover how our next-generation AI solutions can transform your business operations, drive efficiency, and provide you with a competitive edge. Embrace the future of intelligent automation with us.

6th Floor 9 Appold Street, London EC2A 2AP, United Kingdom