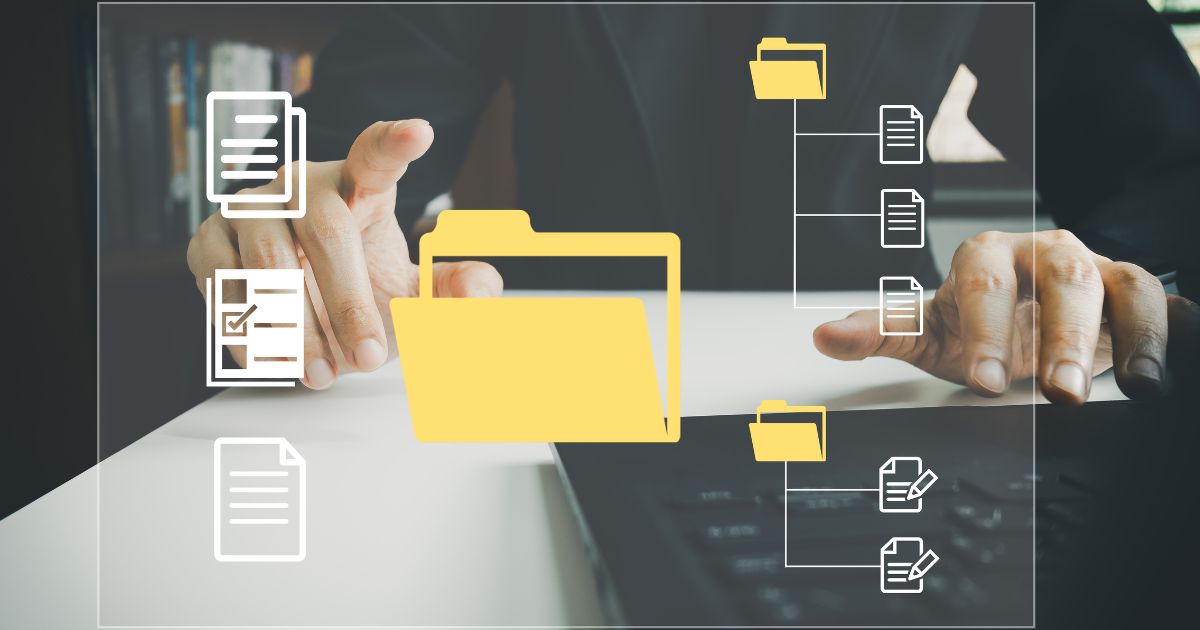

Transform Customer

Onboarding with AI-Powered Document Analysis

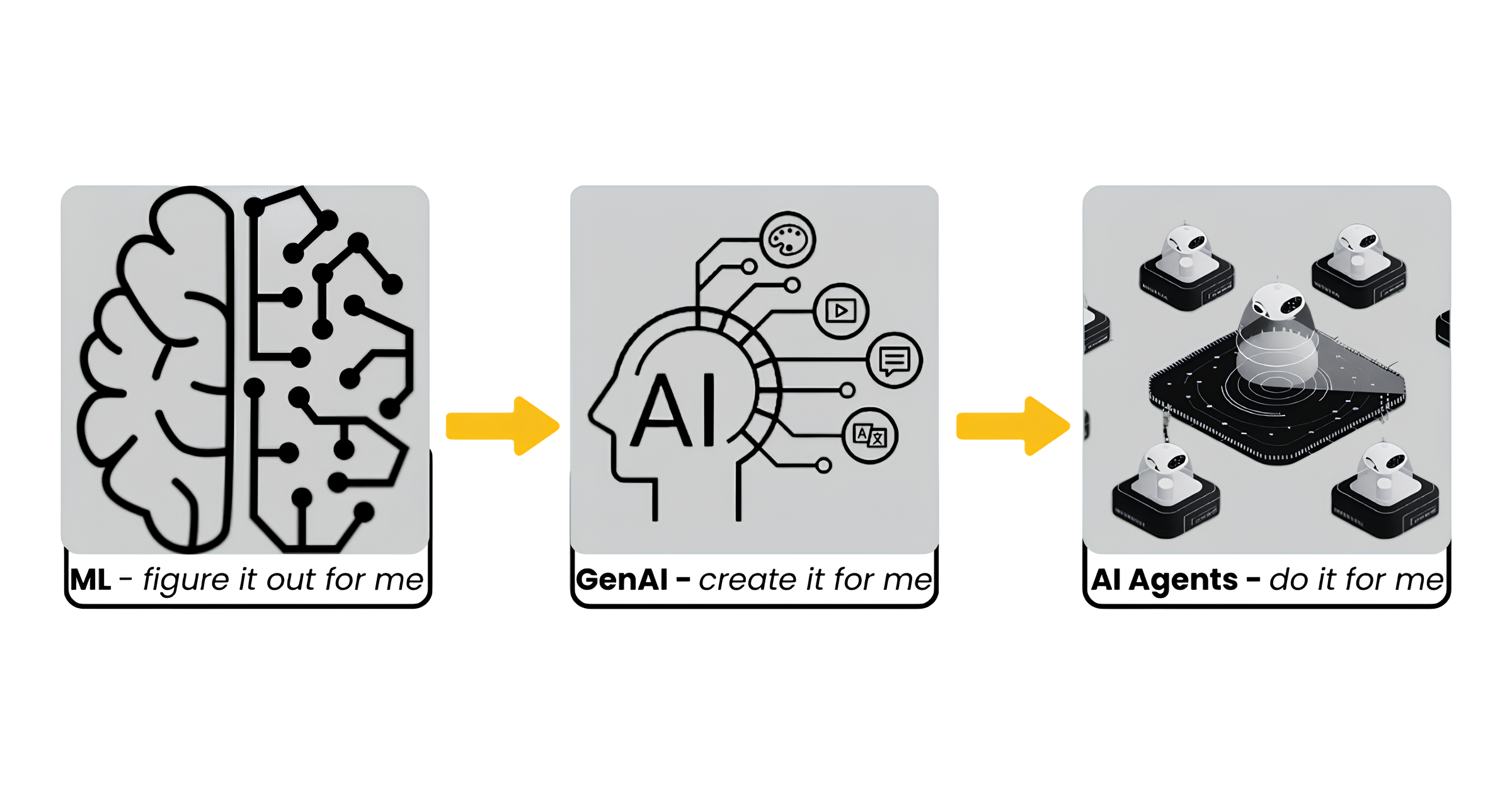

AI-powered document analysis is revolutionizing the customer onboarding process. By using AI algorithms, businesses can automate and optimize the customer onboarding process, improving the customer experience and increasing efficiency.